World Liberty Financial Token Skyrockets Amid Crypto Forum Buzz

By: Eva Baxter

In a recent development, World Liberty Financial Inc.'s (WLFI) token experienced a significant surge in value, climbing over 23% leading up to the much-anticipated cryptocurrency forum at the Mar-a-Lago Club. The event, organized by the company with backing from former U.S. President Donald Trump and his family, has drawn considerable attention from both the crypto community and financial experts. According to reports, the WLFI token saw its price jump to $0.12, up from $0.10, just ahead of the event, which is expected to include discussions on major cryptocurrency policy issues.

This rise in token value has been attributed to a combination of whale buying and a potential short squeeze, indicating heightened interest and trading activity around the token. The trading volume for WLFI recently hit $466 million, showcasing the significant traction the token has gained in the cryptocurrency space. The company's DeFi project is particularly under scrutiny for its ambitious $500 million deal with the United Arab Emirates, which has become a focal point for investors and crypto-enthusiasts alike.

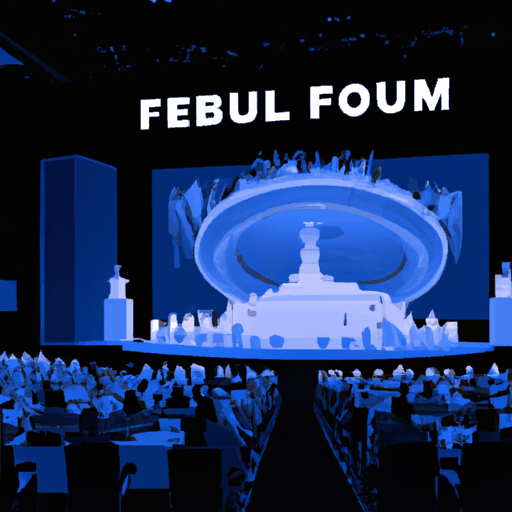

The Mar-a-Lago forum features an impressive lineup of influential figures, including industry leaders and high-profile lawmakers. Despite the absence of former President Donald Trump himself, the event is headlined by his sons, Eric Trump and Donald Trump Jr., who co-founded World Liberty Financial. Attendees such as Coinbase CEO Brian Armstrong and BitGo co-founder and CEO Mike Belshe, alongside regulatory figures like CFTC Chair Michael Selig, are expected to delve into pressing issues surrounding the cryptocurrency landscape. The forum is anticipated to address regulatory changes and the future direction of decentralized finance, offering a platform for key stakeholders to discuss the evolving ecosystem.

The surge in WLFI's market performance underscores how events and endorsements by prominent figures can significantly impact digital asset trading and investor interest. As the forum unfolds, market participants and observers remain keenly attentive to any revelations or policy shifts that might emerge during these high-level discussions. The continuous developments surrounding WLFI, especially with its cross-border collaborations and influential backing, may continue to shape its path in the digital financial world.