Learn Concept: CFTC's Proposal for Spot Crypto Trading on Registered Exchanges

By: Eliza Bennet

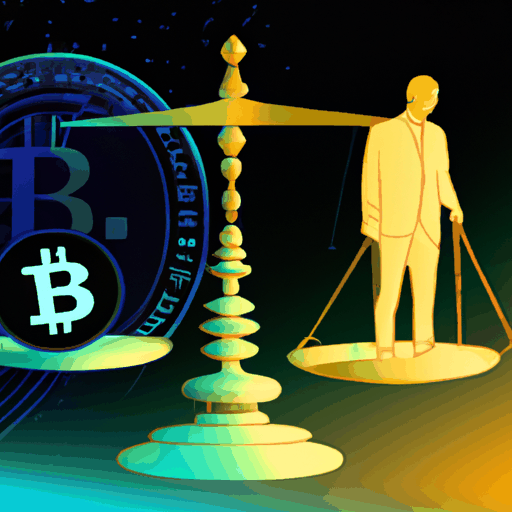

The Commodity Futures Trading Commission (CFTC) in the United States is exploring the potential to allow spot cryptocurrency trading on CFTC-registered futures exchanges. This initiative, part of the CFTC's 'crypto sprint,' aims to bring spot trading into a regulated environment, aligning with federal regulations. The proposal seeks stakeholder feedback to regulate the crypto spot market effectively, ensuring a secure and transparent trading environment. The CFTC's collaboration with the SEC aims to establish an integrated federal regulatory framework, addressing potential legal and regulatory hurdles.

The initiative highlights the evolution of digital asset trading towards a federally regulated status, signaling a maturity phase in cryptocurrency markets. By enabling such transactions, the CFTC is poised to enhance the transparency and security of digital currency trading, critical for maintaining alignment with financial regulations.

Explore more on the CFTC's strategic plans for the crypto market: Read More