Cryptocurrency Market Faces Major Liquidation Amid Bitcoin Slump

By: Isha Das

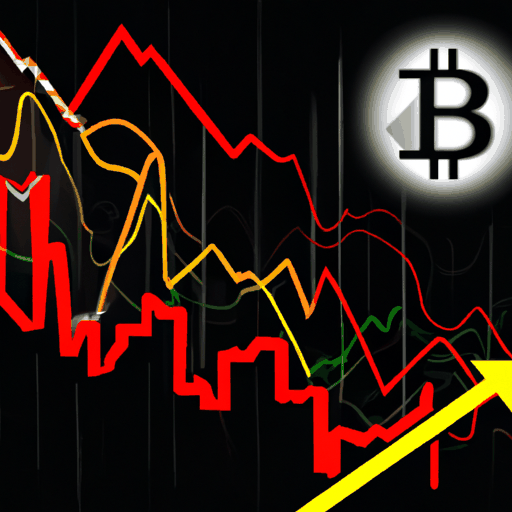

In a dramatic turn of events, the cryptocurrency market has experienced significant volatility with Bitcoin, the leading digital asset, plummeting below $115,000. This decline marks Bitcoin's lowest point since July 11, following a period of sustained market instability. The current downturn follows a peak on July 14 when Bitcoin reached an all-time high of $123,000. However, after multiple attempts to maintain bullish momentum above $118,000 throughout July, Bitcoin failed to gain traction, marking a 7% retracement.

This market instability can be attributed to a range of factors, including aggressive profit-taking by early investors and cautious strategies ahead of recent economic events, such as the Federal Open Market Committee's decision to maintain interest rates. These developments have triggered a significant liquidation phase, accentuating the downside movement. Notably, over $705 million in long positions have been liquidated within the past 24 hours, contributing to Bitcoin's continued decline.

Amidst these turbulent times, the broader cryptocurrency market has mirrored Bitcoin's volatility, with altcoins experiencing substantial losses. Ethereum, Solana, and XRP have all faced declines exceeding 6% within the same period. The rate of liquidations across major exchanges like Binance and Bybit has further accelerated the market downturn, with the overall market shedding more than $680 million in long liquidations. These levels of liquidation highlight a predominantly long-heavy derivatives landscape before the correction.

As Bitcoin's price edges closer to key support levels around $113,500-$114,000, the fear and greed index has shifted to a 'neutral' stance from a previous 'greed' position, reflecting investors' changing sentiments. Despite these market upheavals, Bitcoin's value remains over 8% higher since the start of July, supporting a cautiously optimistic outlook on its long-term potential. However, ongoing concerns regarding declining active addresses and exchange outflows suggest a potentially bearish short-term outlook. Investors and analysts continue to monitor these dynamics closely as the market seeks stability.