BitMine's Aggressive Ethereum Strategy Fuels Unprecedented Stock Surge

By: Eliza Bennet

BitMine, a leading corporate holder of Ethereum, has recently made headlines with its aggressive expansion strategy, filing with the US Securities and Exchange Commission (SEC) to raise an additional $20 billion through a supplemental stock offering. This move amplifies the company's existing at-the-market equity program, bringing their total potential capital raise to a substantial $24.5 billion. The expansion is strategically directed towards increasing Ethereum acquisitions, as well as addressing working capital, debt repayment, income-generating asset purchases, and other corporate necessities, according to the official filing.

This strategic funding effort by BitMine follows closely after the company's purchase of 317,126 ETH within a week, thereby elevating their total Ethereum holdings to an impressive 1.15 million ETH worth more than $5 billion, as assessed by current market prices. Market analysts have projected that this aggressive acquisition might enable BitMine to eventually command control over 5% of Ethereum’s entire supply, marking a significant influence in the cryptocurrency sphere. Such ambitious expansions in Ethereum holdings underscore BitMine's relentless pursuit of an influential position within the crypto market.

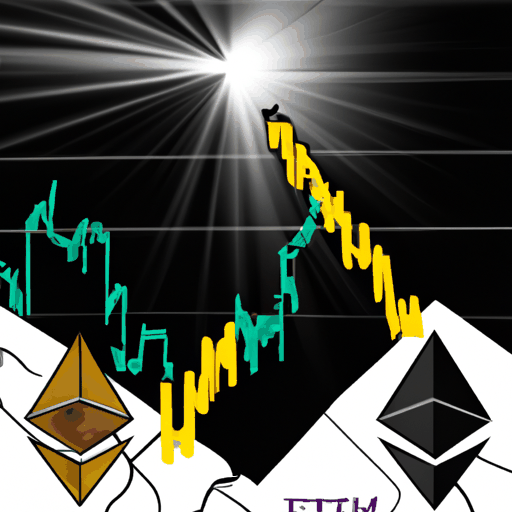

On the back of these developments, BitMine's stock has experienced remarkable growth, with an astonishing 1,100% price increase over a short span, jumping from $4.27 per share a few months ago to $51 now. According to data from Pantera Capital, this surge is mostly attributed to the growing Ethereum per share (EPS) value and a notable rise in Ethereum's market price. The increase in Ethereum's value, from $2,500 to $4,300, has contributed about 20% to BitMine's stock price hike, with the rest driven by substantial EPS enhancements and marginal NAV expansion.