Bitcoin Remains Resilient Amid Bear Market Concerns

By: Eva Baxter

Despite Bitcoin's price dipping below $90,000, sparking concerns about a potential bear market, the cryptocurrency sector is witnessing significant institutional interest. This suggests that major players remain optimistic about the market’s potential. Recently, Republic Technologies secured $100 million in financing in an atypical deal characterized by a zero-interest convertible note, underscoring the evolving and maturing nature of crypto financing. Experts, like Komodo's CTO, acknowledge that while unique, such financial structures may indicate a trend toward innovative funding approaches within the industry.

This notion of increasing institutional recognition is further highlighted by Bitcoin’s market narrative, where major acquisitions and partnerships continue unabated. Reflecting on this trend, industry insiders believe that the current market dynamics do not denote a bear market but rather a transitional phase embracing new financial models.

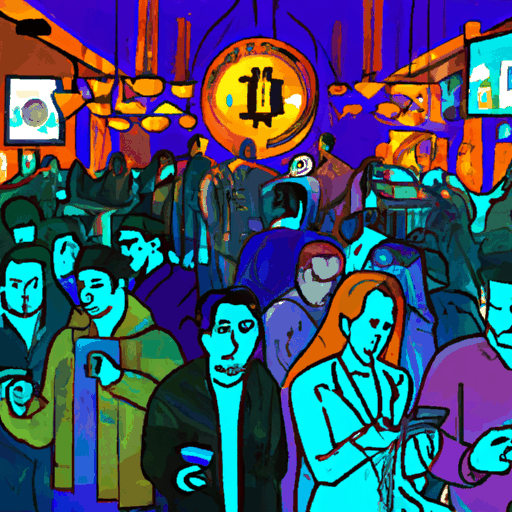

Meanwhile, in a separate but equally captivating development, US Treasury Secretary Scott Bessent’s unexpected visit to a Bitcoin-themed bar, Pubkey, in Washington, DC, raised eyebrows and fueled speculation about the evolving relationship between government entities and the crypto sector. Advocates within the Bitcoin community see Bessent's unannounced appearance as a possible pivot towards a friendlier stance on cryptocurrency from regulatory bodies. The presence of such a high-profile official at a popular crypto venue sends a potent signal about potential shifts in policy and public dialogue concerning Bitcoin and cryptocurrency.

This event at Pubkey isn’t the first of its historical ties, with a New York location rumored to have previously hosted former President Donald Trump who reportedly transacted using Bitcoin. Bessent's visit has sparked discussions on legislative floors about the strategic positioning of Bitcoin, including ideas echoed publicly about integrating Bitcoin into government reserves through initiatives like the GENIUS Act. Despite the public spectacle surrounding the visit, analysts caution against premature assumptions correlating public appearances with immediate policy changes. Instead, they urge weighing any developments against future regulatory and budgetary evaluations that could eventually transform such gestures into actionable policy.

The cumulative effect of these developments suggests a dual narrative: one of robust institutional backing amid market fluctuations, and another of potential regulatory shifts illuminated by significant public interactions. Both align with the broader discourse that Bitcoin's journey continues to attract institutional and governmental attention, pointing to a future ripe with possibilities.