Bitcoin Faces Turbulence Amid Market Volatility

By: Eva Baxter

Bitcoin recently experienced a significant downturn, plummeting below the $85,000 mark, resulting in nearly $600 million in liquidated long positions across the crypto market within 24 hours. The dramatic price drop is attributed to escalating concerns that the Bank of Japan (BoJ) might raise interest rates this week, impacting the yen carry trade that fuels risk assets such as cryptocurrencies and speculative equities.

The rapid price decrease resulted in $218.7 million being liquidated from Bitcoin long positions, and Ethereum faced a similar fate with $213 million wiped out, as reported by Coinglass data. During this period, more than $200 million worth of liquidations occurred in approximately an hour as Bitcoin approached $86,700.

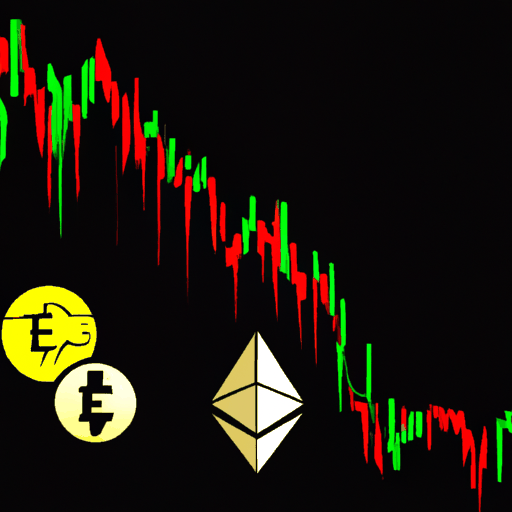

Market participants have linked this selloff to fears of imminent monetary tightening by the BoJ, adding to the challenges of investors who rely on low-interest yen borrowing to invest in higher-yielding assets. Historical data indicates that Bitcoin prices tend to tumble when the BoJ tightens monetary policy, requiring these investors to unwind their positions.

Despite maintaining an above $90,000 value through much of December, Bitcoin's price saw increased spot selling after breaking this level. The cascading liquidations heavily impacted thin order books in the crypto market. This situation is compounded by macroeconomic headwinds following the Federal Reserve's recent meeting. The Fed's consistent hawkish outlook has prompted risk-averse strategies, with Bitcoin's recent "sell-the-news" reaction showcasing traders' anticipation of limited easing in 2025.

The Bitcoin market was not isolated in this downturn, as major altcoins experienced declines alongside the flagship cryptocurrency. Ethereum traded at approximately $2,921.81, reflecting a 4.6% drop in 24 hours. Solana, XRP, BNB, Cardano, and Dogecoin also faced declines, exacerbating an already volatile market environment.

As uncertainty looms over potential changes in monetary policy, the coming hours will be crucial in evaluating Bitcoin's ability to recover from this leverage-induced crash. Traders and investors are now closely watching market movements, attempting to navigate through this challenging financial landscape.