Bitcoin Faces Key Resistance Levels as Bulls Eye New Heights

By: Eva Baxter

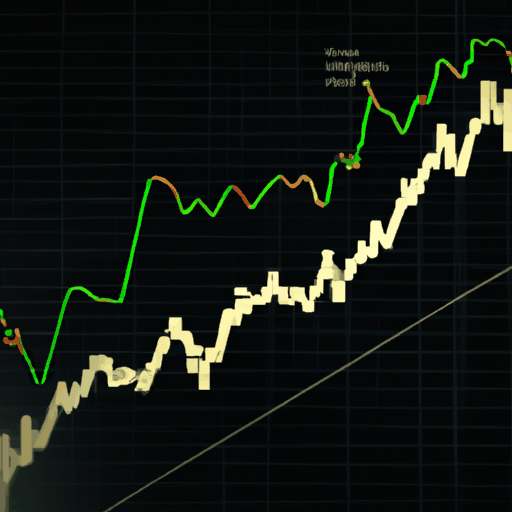

Bitcoin has regained its bullish momentum after overcoming a significant price barrier and currently shows potential for further upward movement. Following a notable increase above the $92,500 threshold, Bitcoin is now positioning itself for another possible breakout, this time above the $93,500 mark. The cryptocurrency has maintained trading above $92,000, well sustained by its 100-hour simple moving average, which has been pivotal in supporting its upward trend.

The recent price fluctuations saw Bitcoin oscillate with a high of $94,050 before it began consolidating its gains. A slight retracement tested the key support levels, notably the 23.6% Fibonacci retracement level from its recent swing low of $83,870. Despite a minor dip, Bitcoin’s overall bullish sentiment remained intact, buoyed by a series of stable market performances. This has kept the price comfortably above $92,000, a critical support point, even as resistance looms at higher zones.

Market experts suggest that should Bitcoin breach the $93,000 resistance convincingly, it could pave the way for a new bullish phase, with the potential to surpass even the $94,000 resistance level. Upon achieving these key milestones, the path could open towards the $95,000 mark, significantly bolstered by strong buyer interest and reduced liquidation pressure, based on recent trading patterns. Positive movement beyond these levels might bring about further gains towards $95,500 and potentially $96,450.

The volatility in Bitcoin's price occurs amidst a contrasting backdrop where major stocks indices are recording gains, drawing a stark dichotomy between traditional financial markets and digital assets. This divergence indicates a complex interplay of market dynamics, possibly impacted by recent liquidations totaling $500 million, which have affected major cryptocurrencies, including Ethereum and XRP. While these adjustments present potential downward risks if key support levels like $90,500 are breached, Bitcoin’s robust trading volume and resilient market support might continue to bolster its upward trajectory.