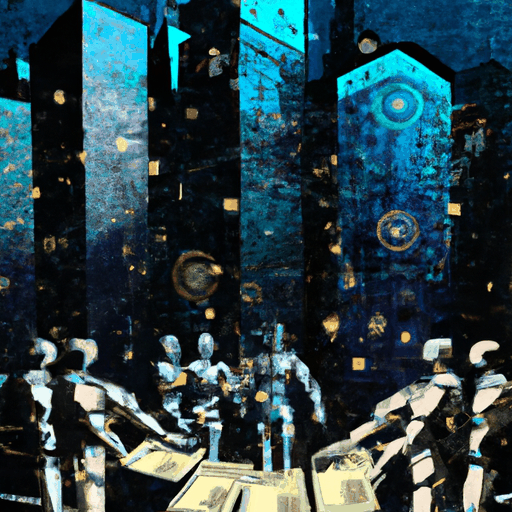

AI Agents to Revolutionize Economic Transactions with Stablecoins

By: Eva Baxter

The integration of artificial intelligence (AI) with cryptocurrencies is poised to transform economic activities as we know it. Jeremy Allaire, CEO of Circle, one of the leading stablecoin issuers, forecasts a future where billions of AI agents conduct transactions autonomously using stablecoins. Speaking at the World Economic Forum in Davos, he emphasized that within three to five years, these AI agents would operate on behalf of humans for a wide range of activities. The Circle CEO underscored the necessity for a stable and programmable currency system, indicating stablecoins as the most suitable option for these AI-driven processes.

During the discussions at Davos, prominent voices included the remarks of Binance co-founder Changpeng Zhao, who reiterated that cryptocurrencies will emerge as the natural economic medium for AI agents. The idea is that these autonomous agents will take over daily financial tasks such as buying goods, settling bills, and tipping service providers. This digital transformation suggests that software agents could function similarly to small businesses, utilizing tokenized dollars, such as USDC by Circle, for their financial operations.

The acceleration of technological infrastructure to support this vision is already underway. Companies are diligently developing protocols that enable machines to approve payments automatically when specific conditions are met. The seamless interaction between software and payment systems is becoming not just a possibility, but an emerging reality. However, this futuristic vision is not without its challenges. Regulatory authorities have raised concerns about the implications on financial systems, particularly in terms of consumer protection and the stability of traditional bank deposits. Legislators are keenly observing these developments, with regulations potentially advancing to accommodate the shift towards 'agentic commerce'.

Technical implications of such sweeping changes cannot be understated. While these intelligent agents offer convenience by efficiently managing transactions, they also raise the stakes for security. Potential risks, including fraud and misuse, necessitate robust systems equipped for identity verification, fault handling, and emergency stops to avoid runaway transactions. Although initial safety measures are being explored, a comprehensive strategy to mitigate these risks remains an area for active development and regulation in this rapidly evolving fintech landscape.